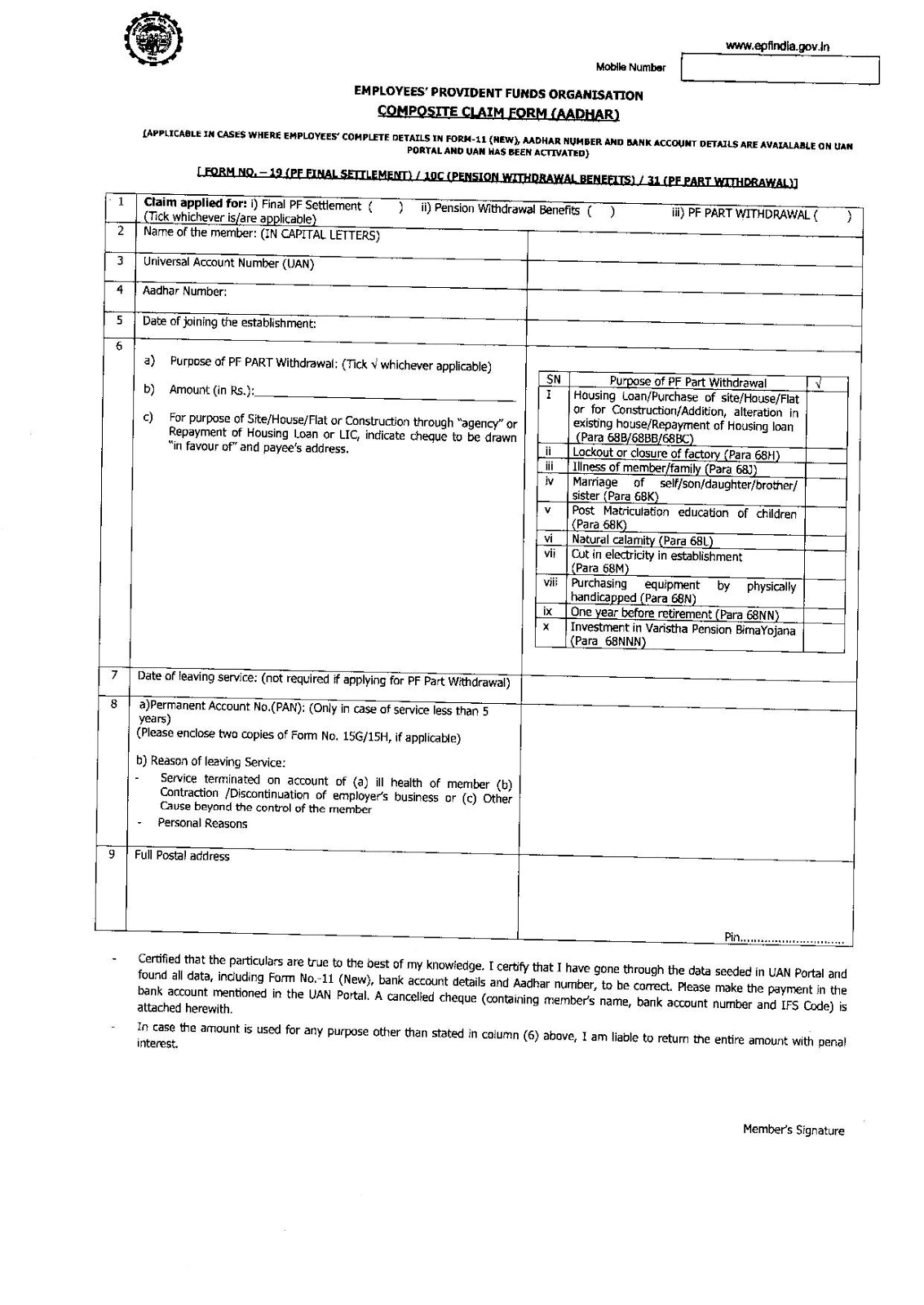

In case the employee left the company they can withdraw their PF savings. You’ll have to submit proof of PAN and form 15G or 15H to avoid TDS, if applicable.The Provident Fund is a financial security for all types of salaried employees right after the retirement.Įvery month of the year some of the amount from the salary of the employee will be deducted and added to the provident fund on the other side the employer would also invest the same amount of money to the employee’s PF account. If you’ve contributed for less than five years -either with one employer or more and have transferred your EPF account from the previous employer-the maturity corpus is taxable. Post submission of your online withdrawal form, money is generally credited to your bank account within 10-15 days. In case of partial withdrawal, you will have to mention the purpose for which you are withdrawing along with the amount. Also, Online Members’ Act of preferring the advance claim online would be taken as her self- declaration for having applied for the same, hence doing away with the need to give any supporting document submitting online EPF withdrawal request. Once you have the pre-requisites covered, you can simply login to the UAN portal of EPF and fill the composite claim form and submit it.

Secondly, UAN has to be linked with your Aadhaar, PAN and bank details along with the IFSC code," said Kukreja. “Firstly, the UAN needs to be activated and the mobile number used for activating the UAN should be in working condition.

For those whose details are not seeded in UAN, they would have to get the employer's attestation before submitting the composite claim form (Non-Aadhaar) to the EPFO.īut before submitting the withdrawal application, couple of pre-requisites need to be factored in.

Also, remember that only those subscribers whose UAN has been linked with their Aadhaar and bank account number can do away with the need to get employer’s attestation for withdrawal, and can directly submit the claim form to the EPFO. Note that you can use the online withdrawal claim facility only if your Aadhaar is linked with your UAN.

0 kommentar(er)

0 kommentar(er)